While it sounds like a joke to talk about saving money, considering what is happening out there, TikTok seems again to find a solution with its new microtrend which apparently is expanding and gets new fans day by day.

Okay, let’s admit that we won’t base our money —and life—decisions on random TikTok trends. However, maybe the no-buy challenge can serve as a springboard for making more informed decisions regarding our personal finances—specifically when it comes to saving money. We all know that saving money is important; the news says that, financial gurus say that, our mothers say that; everyone with basic knowledge knows that life is unpredictable, but our money management shouldn’t be. Saving money is for your finances what flossing or eating your vegetables is for your health—nothing fun but something you must do for your wellbeing.

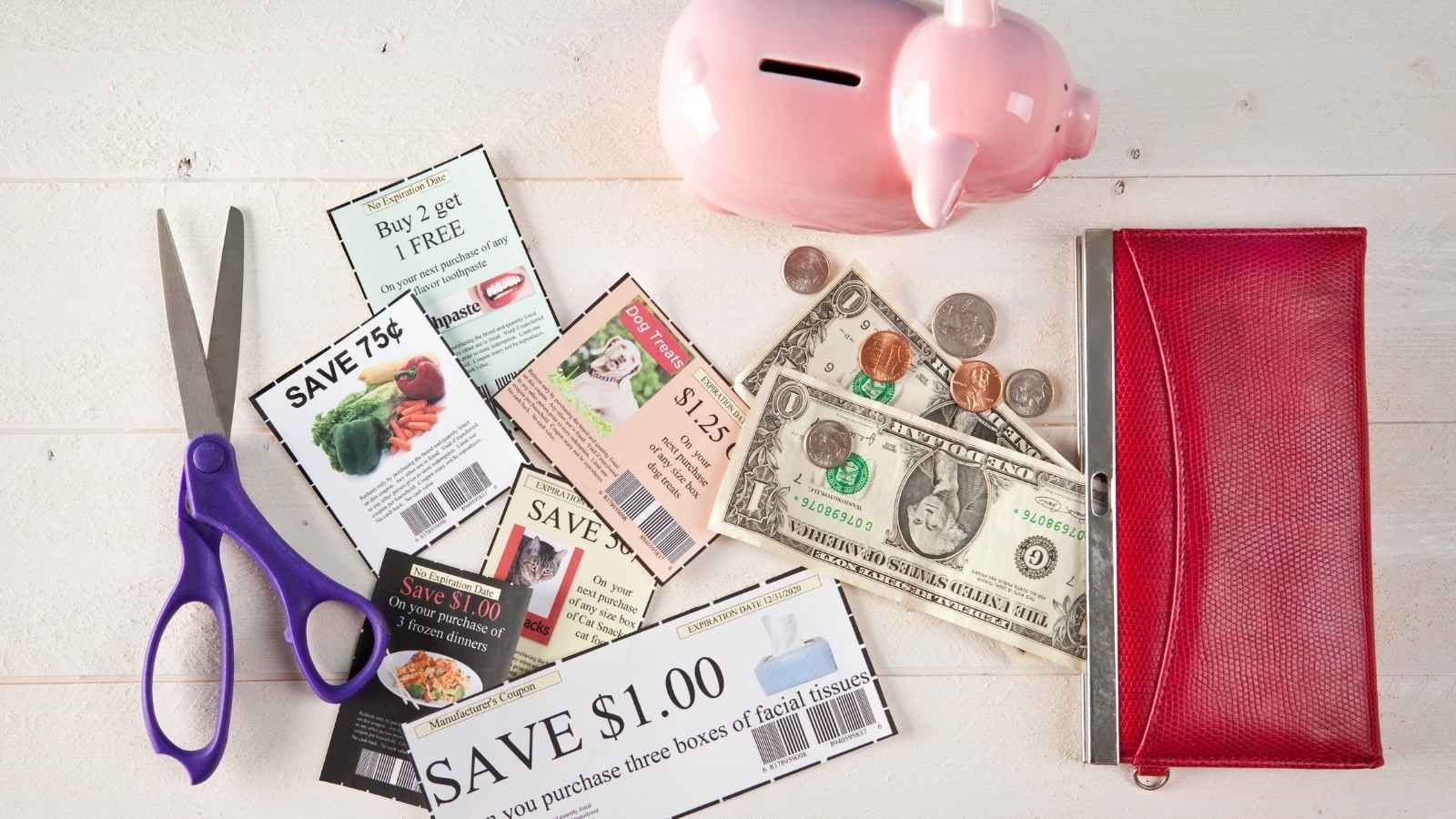

First things first, what exactly is a no-buy challenge? In its purest form, it's a period of time where you consciously restrict your spending to only essential items. Think groceries, rent, utilities –the stuff you absolutely need to survive. Everything else, from that cute new sweater to your daily latte, is off-limits. The duration can vary from a week to a month, or even a whole year (talk about commitment!). Some people go hardcore, cutting out everything beyond the bare necessities. Others opt for a "low-buy" approach, where they set limits on certain categories, like entertainment or dining out. The beauty of the no-buy challenge is that you get to define the rules.

Now, why would anyone willingly subject themselves to this kind of financial austerity? Well, the most obvious reason is to save money. By cutting out impulse purchases and unnecessary expenses, you can free up a surprising amount of cash. If you consider that your daily $5 latte adds up to $150 a month, you can save up to $1800 a year! Suddenly, that dream vacation or down payment on a house seems a little more attainable.

Beyond the immediate financial benefits, a no-buy challenge can also be a powerful tool for self-reflection. It forces you to confront your spending habits and identify areas where you're overspending. Do you really need a new pair of jeans every month? Are those subscription boxes actually bringing you joy, or are they just cluttering your house? By taking a break from shopping, you can gain a clearer sense of your relationship with money and develop healthier spending habits in the long run.

Another unexpected perk of the no-buy challenge is the mental clarity it can bring. In our consumer-driven society, we're constantly bombarded with messages telling us to buy more, buy now, buy the latest and greatest. This consistent pressure can be overwhelming and even lead to high levels of anxiety. Taking a step back from the shopping frenzy can be incredibly liberating. It allows you to focus on the meaningful things in life, whether it's your relationships, your hobbies, or your personal growth.

Okay, so far, so good. But is the no-buy challenge all sunshine and rainbows? Of course not. Like anything worth doing, it comes with its own set of challenges (pun intended!). The biggest hurdle is temptation. Our world is meticulously designed to make us want to buy things—capitalism at its best. From the nonstop targeted ads on social media to the enticement of window shopping, it can be tough to resist the urge to give in. Especially in the early days of a no-buy challenge, you might find yourself experiencing serious FOMO or extended deprivation, like a kid who can see the toy but can’t touch it. Yikes!

And, since we live in an organized (allegedly) society, we should consider the social aspect of a no-buy challenge. Many of our social activities revolve around spending money, whether it's going out to dinner, catching a movie, or celebrating a birthday. Participating in a no-buy challenge might mean having to decline invitations or suggest alternative, less expensive activities. This can be awkward at times, and you might even feel like you're missing out on fun experiences.

So, is the no-buy challenge right for you? The answer, like most things in life, is: it depends. If you're serious about saving money and you're willing to put in the effort, it can be a fantastic way to achieve your financial goals. However, it's not a magic elixir. It requires discipline, commitment, and a willingness to change your habits.

No matter how decisive you are, keep in mind that the no-buy challenge is just a tool. It's not a solution to all your financial problems, but it can be a valuable step in the right direction. So, are you ready to give it a try?

If yes, the following tips may help you:

1. Minimize takeaway and start cooking. There are countless easy recipes with simple ingredients you can make within 10 minutes. Also, wave goodbye to your morning latte and make your own coffee at home. Treat yourself with your latte during the weekend or on special occasions (no, showing up at work doesn’t count as a special occasion!).

2. Shop smart. When you don’t have time, you usually don’t pay attention to special offers or discounts, and you end up spending lots of money on things that you could find cheaper. Private brands in grocery stores are pretty much the same as the popular ones but cost much less. Do you really want to spend all those bucks on toilet paper? Don’t think so. At the end of the month, you will definitely see some improvement in your bank account.

3. Stop being a fashion victim. Fashion trends change pretty much every month. The sweater you buy today will probably be out of fashion in 6 weeks. And then what? Being fashionable doesn’t mean you need to renew your closet every month. Take some of your valuable time and rearrange your closet. What do you wear and what don’t you wear? While doing this, you will definitely find pieces that were hidden, and you have forgotten about them. Use them as if you just bought them. Nobody will tell the difference, and you will cover your —emotional, mainly—need for new clothes.

THE WORKING GAL

THE WORKING GAL